CRISPR-based POC Diagnostics Market Size Report, 2033

CRISPR-based POC Diagnostics Market Summary

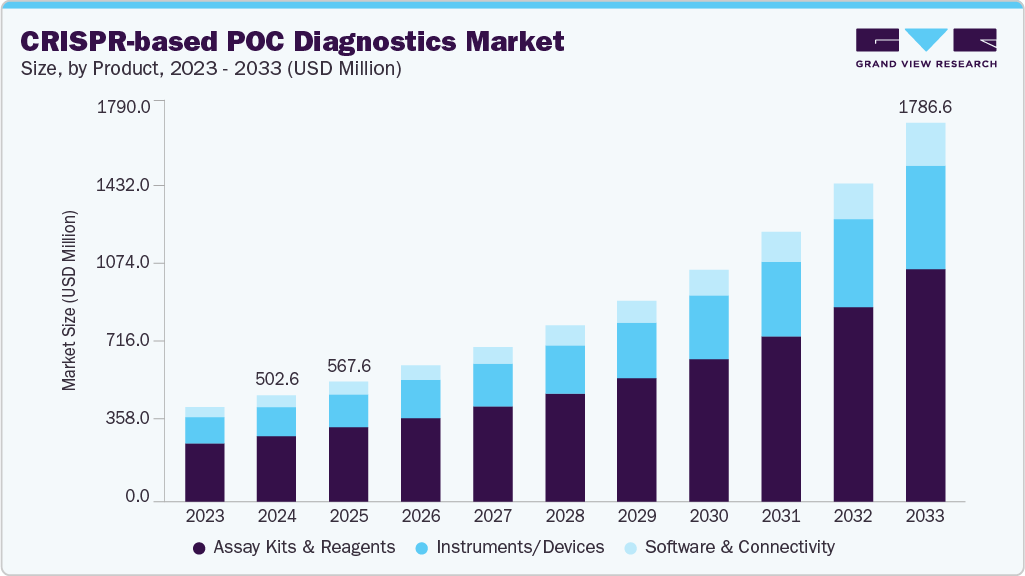

The global CRISPR-based POC diagnostics market size was estimated at USD 502.64 million in 2024 and is projected to reach USD 1,786.56 million by 2033, growing at a CAGR of 15.41% from 2025 to 2033. The market is expanding as diagnostic capabilities shift closer to the point of care, supported by broader availability of testing in regions with limited healthcare infrastructure.

Key Market Trends & Insights

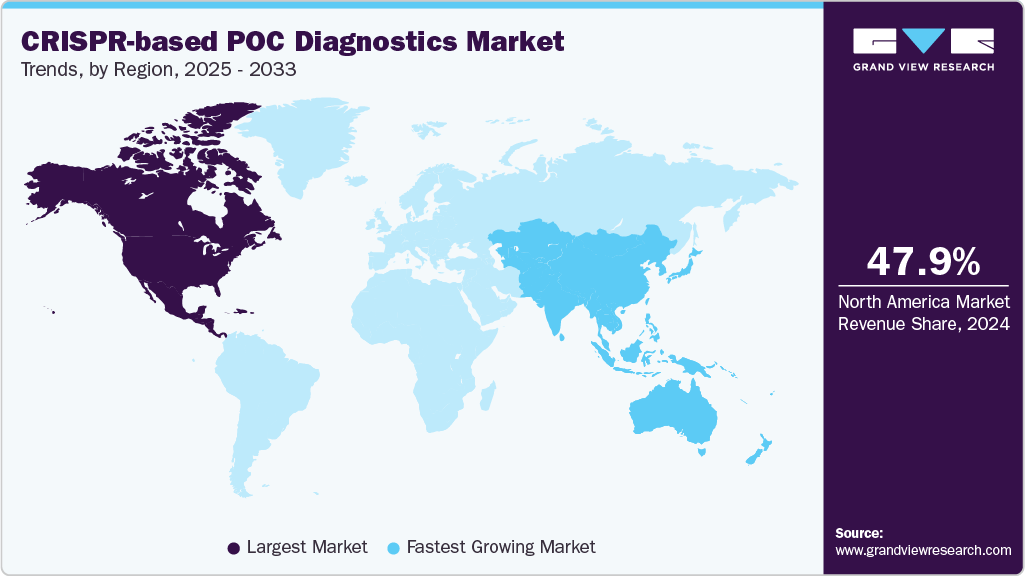

- North America CRISPR-based POC diagnostics market dominated with the largest revenue share of 47.91% in 2024.

- The U.S. led the North American market and held the largest revenue share in 2024.

- Based on product, the assay kits and reagents segment dominated the global market with a 61.93% share in 2024.

- Based on technology, the Cas12-based (DETECTR technology) segment held the largest revenue share of 47.03% in 2024.

- On the basis of application, the infectious disease diagnostics segment held the largest revenue share of 61.60% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 502.64 Million

- 2033 Projected Market Size: USD 1,786.56 Million

- CAGR (2025-2033): 15.41%

- North America: Largest Market in 2024

- Asia Pacific: Fastest growing market

Cost-effectiveness, high accuracy, and ease of use propel adoption across healthcare systems globally. Strategic partnerships are bringing innovations into the market, specifically in underserved settings. For instance, in August 2023, Crisprbits partnered with Molbio Diagnostics Limited to launch CRISPR-based point-of-care tests to provide cost-effective, innovative, and highly accurate diagnostic solutions while expanding market opportunities and transforming point-of-care diagnostics.

Furthermore, the increasing prevalence of infectious diseases is a major factor propelling the growth of the market. The global burden of infectious conditions such as influenza, tuberculosis, viral hepatitis, and sexually transmitted infections (STIs) has risen steadily, creating an urgent need for rapid, accurate, and affordable diagnostic solutions. In February 2025, the WHO noted that seasonal influenza continues to pose a significant global health burden, with an estimated one billion cases reported annually, including 3-5 million cases of severe illness. The infection is responsible for 290,000 to 650,000 respiratory deaths each year, underscoring its substantial impact on public health systems worldwide. Significantly, 99% of influenza-related lower respiratory tract infection deaths among children under five occur in developing countries, highlighting stark inequalities in healthcare access and outcomes. Moreover, the WHO stated in September 2025 that every day, more than 1 million treatable sexually transmitted infections (STIs) are acquired in people aged 15 to 49 worldwide, with the majority of them asymptomatic. In 2022, an estimated 8 million adults aged 15 to 49 were infected with syphilis.

In addition, the market is expanding rapidly due to the increasing global burden of genetic diseases and the growing demand for rapid, accurate, and cost-effective testing. Traditional PCR and RT-PCR methods, although precise, require sophisticated equipment, trained personnel, and lengthy turnaround times, which limit their utility in resource-constrained and decentralized settings. CRISPR/Cas systems (Cas9, Cas12, and Cas13) offer unparalleled sensitivity, specificity, and programmability, enabling the detection of cancers and genetic variants with single-nucleotide resolution within an hour. Platforms like SHERLOCK and DETECTR have achieved attomolar sensitivity with simple lateral flow or fluorescence readouts, making them excellent candidates for point-of-care applications. CRISPR diagnostics, which combine molecular precision with operational simplicity and scalability, are reshaping the global diagnostics landscape and driving adoption in hospitals, clinics, and decentralized testing programs.

Moreover, the growing global urgency to address antimicrobial resistance (AMR), which has become one of the most important challenges in modern healthcare, is boosting the demand for the CRISPR-based POC diagnostics. Hospitals and healthcare systems worldwide are under increasing pressure to rapidly detect and contain antibiotic-resistant infections, thereby preventing costly outbreaks and improving patient outcomes. CRISPR-based diagnostic platforms offer a compelling value proposition by delivering fast, highly accurate, and easy-to-use testing solutions that reduce reliance on centralized laboratory facilities. These technologies enable clinicians to make early and targeted treatment decisions, minimizing the misuse of antibiotics and optimizing resource utilization. Their portability and scalability make them particularly attractive for deployment in resource-limited settings and point-of-care environments. By combining precision, speed, and accessibility, CRISPR diagnostics are revolutionizing the infectious disease diagnostics market and establishing new benchmarks for efficiency in clinical decision-making. For instance, in February 2025, Crisprbits (India) developed PathCrisp, a molecular diagnostic platform that uses CRISPR technology to detect antibiotic resistance in hospital-acquired infections. The technology is intended to allow early identification of AMR, a major worldwide health concern, particularly in intensive care units (ICUs).

Market Concentration & Characteristics

The market demonstrates a high degree of innovation, driven by breakthroughs in gene editing and molecular detection technologies. Companies are focusing on Cas enzymes such as Cas12 and Cas13 to create ultra-sensitive, programmable diagnostic assays capable of single-nucleotide precision. These innovations enable the rapid detection of pathogens, genetic screening, and the identification of antimicrobial resistance at the point of care. Moreover, integration with portable devices, microfluidic chips, and AI-based data analytics accelerates product differentiation, making CRISPR diagnostics a transformative force in next-generation healthcare testing.

Mergers and acquisitions within the CRISPR-based diagnostics sector are increasing as established biotech and diagnostic companies seek to expand technological capabilities and market presence. Strategic partnerships among CRISPR innovators, healthcare providers, and device manufacturers to accelerate commercialization fuel the market growth. For instance, in February 2023, Sherlock Biosciences acquired Sense Biodetection (U.S.) to accelerate the commercialization of disposable CRISPR-based point-of-care diagnostics. The integration of Sense’s instrument-free hardware with Sherlock’s CRISPR technology aims to deliver rapid, low-cost, and sustainable molecular testing. Moreover, its platform provides lab-quality results within 15 minutes, combining PCR-level accuracy with the simplicity of an antigen test. In addition, notable acquisitions target startups with proprietary CRISPR platforms, intellectual property portfolios, and regulatory advancements boost market growth.

The regulatory environment for CRISPR-based diagnostics is evolving, with agencies such as the FDA and EMA developing frameworks for validation, biosafety, and clinical performance. In addition, regulatory approvals are increasingly supportive of innovative molecular technologies; however, CRISPR diagnostics still face moderate challenges in standardization and quality assurance. The market’s medium regulatory impact reflects ongoing harmonization efforts across regions to streamline approval timelines. As CRISPR-based tests demonstrate robust clinical accuracy and reliability, regulatory acceptance is expected to increase, paving the way for broader adoption in healthcare.

Product expansion in the CRISPR-based point-of-care diagnostics market is moderate, with targeted diversification into infectious disease testing, oncology, and genetic screening applications. Companies are developing next-generation assays that are ideal for field deployment and decentralized healthcare settings. Furthermore, while innovation remains strong, mass commercialization faces significant challenges in terms of scalability and cost optimization. Ongoing research collaborations and licensing agreements are gradually expanding the application portfolio, thereby improving product availability and adaptability in both developed and emerging markets.

Regional expansion for CRISPR-based point-of-care diagnostics is steadily increasing, with North America and Europe leading the way in early adoption due to advanced healthcare infrastructure and significant R&D investments. The Asia Pacific region is emerging as a significant growth area, driven by increasing healthcare spending, government support for biotech innovation, and rising demand for rapid diagnostics. However, due to limited funding and regulatory alignment, widespread adoption in Latin America and Africa has been slow to materialize.

Product Insights

The assay kits and reagents segment held the largest share of approximately 61.93% in 2024, owing to rising adoption of rapid molecular screening, increased demand for ready-to-use CRISPR reaction mixes, and a shift toward decentralized and emergency testing. Advances in lyophilized CRISPR reagents, multiplex reaction chemistries, and low-cost Cas enzymes, designed for field deployment, have all contributed to driving growth. In addition, Cas12a-enabled confirmation systems are increasingly being integrated to enhance diagnostic reliability, especially when PCR outcomes are unclear. This aligns with the advancement of the Specific Enhancer for Detection of PCR-amplified Nucleic Acids (SENA), a China-developed Cas12a-based method designed to provide more accurate post-PCR verification. For instance, in May 2021 update by Karen O’Hanlon Cohrt, SENA leverages Cas12a transcleavage activity alongside real-time PCR to resolve “grey zone” Ct-value cases, improving detection reliability and reducing false positives/negatives. This innovation boosts demand for high-performance CRISPR assay kits and reagents across clinical settings.

Moreover, the software and connectivity platforms segment is anticipated to grow at the fastest rate over the forecast period, owing to the growing integration of digital tools that improve test interpretation, data management, and remote clinical decision-making in CRISPR-based point-of-care diagnostics. The growing use of cloud-based analytics, AI-assisted result interpretation, and real-time disease surveillance systems allows for faster reporting and higher diagnostic accuracy, especially in decentralized and resource-constrained environments. In addition, connectivity platforms enable seamless integration with electronic health records (EHRs), mobile health applications, and telemedicine workflows, thereby improving operational efficiency for clinicians and public health authorities.

Technology Insights

Based on technology, the Cas12-based (DETECTR technology) segment represented the largest market share of 47.03% in 2024, due to its rapid, amplification-compatible detection mechanism, high analytical sensitivity, and ability to deliver accurate results within minutes at the point of care. The increasing use of Cas12 platforms in infectious disease testing, the expansion of validation studies across hospitals and reference laboratories, and the rising demand for scalable, low-cost diagnostic tools all accelerated market penetration. Moreover, increased government and industry investment in CRISPR innovations, as well as the incorporation of DETECTR assays into portable diagnostic devices, have strengthened their position as a global molecular diagnostic leader.

Moreover, the Cas13-based (SHERLOCK technology) segment is expected to record the fastest CAGR during the forecast period, driven by its exceptional sensitivity for RNA targets, ability to detect low viral loads without complex instrumentation, and suitability for rapid point-of-care diagnostics. Technology’s growing use in respiratory, tropical, and emerging infectious disease detection, along with expanding partnerships, has accelerated adoption. In addition, the increasing involvement of the companies in the intellectual properties associated with their products is boosting the growth of the market. For example, in February 2023, Sherlock Biosciences obtained exclusive rights in the U.S. for an important CRISPR diagnostics patent, which improved its competitive edge over Mammoth Biosciences, Inc. and reinforced its leadership in the market.

Application Insights

The infectious disease diagnostics segment accounted for the largest market share of 61.60% in 2024 due to the escalating prevalence of viral and bacterial outbreaks that require rapid, decentralized testing solutions. CRISPR platforms enable ultra-sensitive detection within minutes, making them ideal for frontline and resource-limited settings. Furthermore, the rising burden of global viral infectious diseases is boosting the growth of the market. As per the WHO’s latest data from 187 countries, the estimated number of viral hepatitis deaths increased from 1.1 million in 2019 to 1.3 million in 2022. In addition, Hepatitis B caused 83% of this, with hepatitis C accounting for 17%.

The antimicrobial resistance (AMR) testing segment is the fastest-growing segment during the forecast period, driven by the increasing global burden of drug-resistant pathogens and the need for rapid, gene-level resistance identification. CRISPR-based assays enable precise detection of resistance markers within minutes, supporting timely, targeted treatment decisions and reducing inappropriate antibiotic use. The CDC stated in February 2025 that AMR is an urgent global public health threat, and in the U.S., more than 2.8 million antimicrobial-resistant infections occur each year. These trends are accelerating the demand for rapid AMR-focused CRISPR diagnostics, thereby boosting market growth.

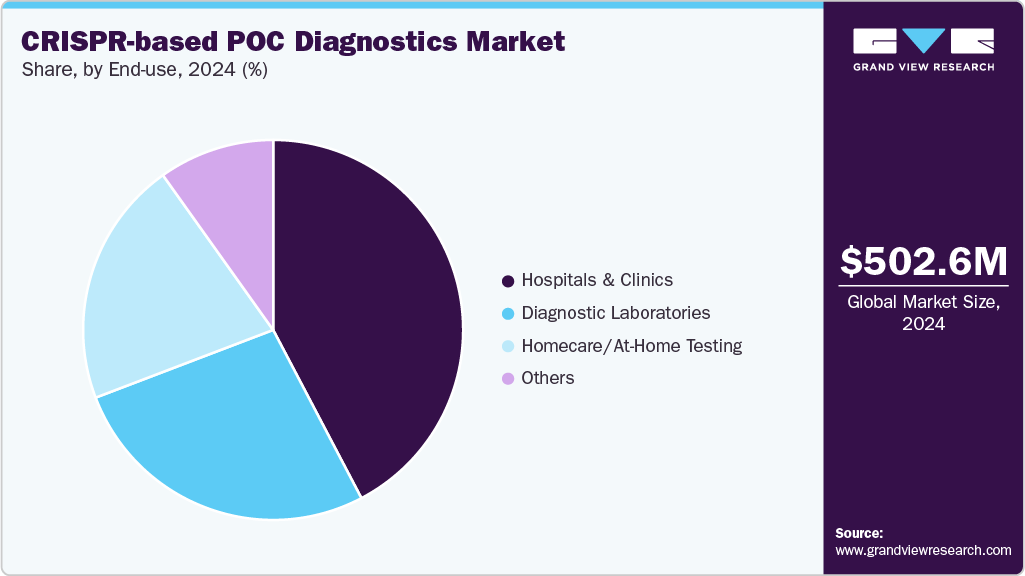

End-use Insights

Hospitals and clinics dominated the CRISPR-based POC diagnostics market in 2024, accounting for 42.31% of the share, fueled by the urgent need for fast, high-accuracy tests in patient care and growing adoption of CRISPR assays for infectious disease detection. For example, CRISPR-Cas diagnostics have been reviewed for rapid COVID-19 testing in clinical settings, emphasizes their potential in small clinics and hospitals lacking centralized lab infrastructure. Strategic partnerships are bringing CRISPR POC tests directly into clinical workflows; for instance, in August 2025, Crisprbits partnered with Molbio Diagnostics Limited to deploy CRISPR-based POC tests in hospitals, clinics, and resource-constrained settings.

The homecare / at-home testing segment is expected to witness the fastest growth during the forecast period, owing to increased consumer demand for convenient, quick, and non-invasive self-testing options. CRISPR-based at-home test formats are gaining popularity as awareness of early disease detection increases, telehealth services expand, and decentralized diagnostics become more prevalent. Moreover, advancements in portable assay kits, smartphone-enabled readouts, and user-friendly CRISPR platforms allow for molecular-level accuracy outside of clinical settings. The normalization of self-testing for infectious diseases following the pandemic, as well as initiatives by diagnostic companies to commercialize low-cost and user-friendly CRISPR test kits, are expected to boost the segment’s growth prospects.

Regional Insights

The North America CRISPR-based POC diagnostics market held the largest share in 2024, driven by faster, highly sensitive CRISPR assays that match PCR accuracy while delivering results at or near the patient, rising R&D and venture capital funding for decentralized testing, pandemic-era acceleration of molecular POC adoption, favorable regulatory momentum for novel molecular formats, and strategic partnerships between CRISPR startups and larger diagnostics players. These drivers enabled rapid commercialization of POC devices, including Sherlock Biosciences’s product, the Sherlock CRISPR SARS-CoV-2 Kit, and Mammoth Biosciences, Inc.’s product, the DETECTR Platform, and smaller firms like Proof Diagnostics developing CRISPR POC panels; all examples of how sensitivity, speed, and accessibility are reshaping frontline testing.

U.S. CRISPR-based POC Diagnostics Market Trends

The U.S. CRISPR-based POC diagnostics industry is growing rapidly due to increasing demand for rapid, decentralized infectious-disease testing, technological advancements in CRISPR-Cas detection systems, and rising investment in precision medicine and biosensor innovation. Moreover, supportive regulatory pathways and funding from agencies such as NIH are accelerating commercialization. Increasing collaboration among academic and research institutions is boosting innovation and moving CRISPR diagnostics from lab to clinic. For instance, in June 2024, the Broad Institute of MIT and Harvard and Princeton University launched a paper strip test using CRISPR and streamlined highlighting of infections to navigate epidemics (SHINE) technology for rapid, low-cost influenza diagnosis to distinguish between influenza A and B strains and guide treatment decisions.

Europe CRISPR-based POC Diagnostics Market Trends

The CRISPR-based POC diagnostics industry in Europe is expected to significantly over the forecast period, owing to increased demand for rapid infectious-disease testing, regulatory and funding support for decentralized diagnostics, and ongoing improvements in Cas12/Cas13 assay sensitivity and ease-of-use, allowing for lateral-flow and minimal-instrument workflows. Advances in isothermal amplification + CRISPR readouts, lower assay costs, and collaborations between biotech and diagnostics firms are fostering commercialization, while applications expand beyond infectious disease to oncology and antimicrobial resistance detection.

The UK CRISPR-based POC diagnostics industry is growing rapidly, driven by increasing demand for rapid molecular testing, government support for advanced biotechnology, and ongoing innovation in CRISPR-Cas systems enabling faster and more accurate nucleic acid detection. Furthermore, growing healthcare digitization and a focus on pandemic preparedness are accelerating adoption. In addition, increasing acquisitions and strategic alliances are accelerating the commercialization and market introduction of innovative handheld tests. For instance, in February 2023, Sherlock Biosciences (U.S.) acquired Sense Biodetection (UK) to accelerate the launch of handheld diagnostic tests powered by CRISPR gene-editing technology. Sherlock had previously raised USD 80 million to advance the development of its CRISPR-based diagnostic portfolio, underscoring strong investment momentum in the UK market.

The CRISPR-based POC diagnostics industry in Germany is driven by a strong combination of world-class research institutions, growing health-system demand for rapid decentralized testing, and accelerating technological advances in CRISPR (Cas12/Cas13) assays that make sensitive, rapid point-of-care use possible. Moreover, robust federal and private funding, coupled with Germany’s high healthcare spending and digital-health infrastructure, is fueling the market growth. Major Germany organizations and companies playing important roles include QIAGEN, Miltenyi Biotec, Akribion Genomics, and other local spinouts, plus research hubs like Helmholtz Munich and the Max-Delbrück Center that advance assay development and validation.

Asia Pacific CRISPR-based POC Diagnostics Market Trends

The CRISPR-based POC diagnostics industry in the Asia Pacific is projected to be the fastest-growing region during the forecast period. This rapid growth is primarily attributed to several key factors, including the rising burden of infectious diseases, increasing investments in biotechnology research, growing government support for decentralized healthcare, and advancements in CRISPR-based molecular technologies. In addition, the increasing prevalence of respiratory diseases such as tuberculosis (TB) is significantly driving the market. For instance, according to the World Health Organization (WHO), in 2022, most TB cases (about 46%) occurred in the WHO South-East Asia Region, presenting the urgent need for efficient and accessible diagnostic solutions in the region.

In addition, the presence of robust local biotechnology ecosystems, collaborations among academic institutions and diagnostic companies, and the demand for low-cost, portable, and precise testing kits in rural and resource-constrained areas are all driving market growth. These factors, combined with rising awareness of early disease detection, growing healthcare spending, and a post-pandemic emphasis on rapid molecular testing, are driving the Asia-Pacific region’s CRISPR-based point-of-care diagnostics market to its fastest growth.

The Japan CRISPR-based POC diagnostics industry is witnessing significant growth due to the rising demand for rapid, accurate, and cost-effective diagnostic solutions. The increasing prevalence of infectious diseases, such as COVID-19 and influenza, has accelerated the adoption of CRISPR-based technologies for real-time testing and decentralized healthcare delivery. In October 2025, this trend gained momentum as Japan faced an unprecedented influenza outbreak, prompting urgent public health responses. According to Japan’s National Institute of Infectious Diseases (NIID), the average number of influenza patients per hospital surpassed the epidemic threshold, with over 6,000 hospitalizations reported across Tokyo, Okinawa, and Kagoshima. This early and widespread influenza epidemic, the most severe in nearly two decades, emphasizes the critical need for faster, more portable diagnostic tools. As a result, investment and research in CRISPR-based point-of-care diagnostics have increased, as healthcare providers seek quick and accurate detection methods to contain outbreaks and protect public health in Japan’s evolving post-COVID diagnostic landscape.

The CRISPR-based POC diagnostics industry in China is experiencing notable growth, driven by the rising prevalence of infectious diseases, increasing demand for rapid and accurate testing solutions, and growing government initiatives to strengthen healthcare infrastructure. The adoption of CRISPR-based diagnostic technologies is being accelerated by their ability to deliver precise, low-cost, and field-deployable testing options, particularly in resource-limited settings. In addition, a major factor fueling market expansion is the growing burden of viral infections and chronic diseases that require early detection for effective management. For instance, in March 2025, the Chinese Center for Disease Control and Prevention reported 128,992 cases of Hepatitis B and 17,661 cases of Hepatitis C among the national notifiable infectious diseases. Moreover, continuous research investments and partnerships between biotech firms and academic institutions are propelling innovation, positioning China as one of the fastest-emerging markets in CRISPR-based POC diagnostics.

Latin America CRISPR-based POC Diagnostics Market Trends

The CRISPR-based POC diagnostics industryin Latin America is being driven by rising demand for accessible, quick, and affordable diagnostic technologies, particularly in areas with limited laboratory infrastructure. The rising prevalence of infectious diseases like dengue, Zika, Chikungunya, and tuberculosis has increased the demand for advanced, low-cost diagnostic tools that can provide quick results in rural and underserved areas.

Moreover, governments and public health organizations throughout Latin America are increasing their investments in molecular diagnostics and biotechnology research to improve disease surveillance systems. Collaborations between regional biotech startups, universities, and international partners are accelerating the adoption of CRISPR-based platforms. Growing awareness of precision medicine, combined with initiatives to modernize healthcare systems, is driving the adoption of CRISPR-based POC solutions, establishing Latin America as an emerging hub for innovative diagnostic development.

The Brazil CRISPR-based POC diagnostics industry is growing steadily, owing to the country’s strong emphasis on healthcare modernization, domestic biotechnology innovation, and government-funded genetic and molecular diagnostics research. Brazil’s research infrastructure, which is supported by leading institutions such as Fiocruz, Butantan Institute, and major federal universities, promotes the development and local production of advanced diagnostic technologies, such as CRISPR-based platforms. The country’s large and diverse population creates an ongoing demand for scalable and decentralized testing solutions to manage infectious and chronic diseases. Moreover, the growth of local biotech startups, increased investment from Brazil’s Ministry of Science, Technology, and Innovation (MCTI), and collaborations with global life sciences companies are all driving the market forward. Furthermore, Brazil’s push for diagnostic manufacturing self-sufficiency, combined with growing awareness of precision medicine, is driving adoption of CRISPR-based point-of-care diagnostics.

Middle East and Africa CRISPR-based POC Diagnostics Market Trends

The CRISPR-based POC diagnostics industry in the Middle East and Africa is observing a growing need for rapid, accurate, and affordable diagnostic tools to manage infectious diseases and emerging health threats. The region faces a high prevalence of communicable diseases such as HIV, tuberculosis, malaria, and viral hepatitis, which has created a strong demand for innovative molecular testing solutions. As per UNICEF, approximately 20,000 people in the MENA region contracted HIV in 2022. Nearly 20% were young people aged 15 to 24, mostly from Algeria, Egypt, Iran, Saudi Arabia, Sudan, and Yemen. In addition, CRISPR-based POC diagnostics offer high sensitivity, quick turnaround times, and ease of use, making them ideal for decentralized healthcare settings where laboratory infrastructure is often limited. In addition, increasing government efforts to strengthen disease surveillance systems, improve healthcare accessibility, and invest in biotechnology research are fueling market growth.

The UAE CRISPR-based POC diagnostics industry is expanding rapidly, primarily due to the country’s strong focus on healthcare innovation, advanced biotechnology research, and government-backed initiatives to establish itself as a regional leader in precision medicine. The UAE’s national strategies, such as the UAE National Biotechnology Strategy and Vision 2031, prioritize the use of cutting-edge technologies such as CRISPR for disease detection, genetic research, and personalized healthcare. The country’s significant investment in life sciences infrastructure, combined with the presence of world-class research institutions and collaborations with global biotech companies, is fueling the commercialization of CRISPR-based POC diagnostic tools.

Key CRISPR-based POC Diagnostics Company Insights

The market features several key players driving innovation and adoption. Leading companies include Mammoth Biosciences, Inc., OraSure Technologies, Inc. (Sherlock Biosciences), Caspr Biotech, GenScript, and Integrated DNA Technologies, Inc., among others. These companies are not only developing core CRISPR detection chemistries but also reshaping the competitive landscape with aggressive R&D spending, accelerated product pipelines, and targeted market penetration strategies. Their activities are increasingly focused on developing highly scalable, instrument-free, or portable platforms, forming cross-sector partnerships with diagnostics manufacturers and academic research institutes, and increasing regulatory submissions in major markets. As a result, the CRISPR-based point-of-care diagnostics ecosystem is becoming more diverse and commercially robust, with ongoing innovations, licensing agreements, and global commercialization efforts propelling faster adoption in clinical, decentralized, and resource-constrained healthcare settings.

Key CRISPR-based POC Diagnostics Companies:

The following are the leading companies in the CRISPR-based POC diagnostics market. These companies collectively hold the largest market share and dictate industry trends.

- Mammoth Biosciences, Inc.

- OraSure Technologies, Inc. (Sherlock Biosciences)

- Caspr Biotech

- GenScript

- Integrated DNA Technologies, Inc.

- Synthego

- Revvity Discovery Limited

- Twist Bioscience

- Crisprbits

- Danaher Corporation (Cepheid)

Recent Developments

-

In September 2025, VedaBio, Inc. announced a non-exclusive licensing agreement with Mammoth Biosciences, Inc., which will provide access to key CRISPR intellectual property for diagnostic use. The deal will help VedaBio accelerate the development of high-speed, high-accuracy molecular detection tools, thereby advancing next-generation diagnostic platforms designed for decentralized and point-of-care healthcare environments.

-

In December 2024, OraSure Technologies, Inc. acquired Sherlock Biosciences, strengthening its diagnostic portfolio with Sherlock’s rapid, disposable molecular testing platform. The deal includes a coming self-test for chlamydia and gonorrhea, as well as funding for the development of additional assays using isothermal amplification and next-generation CRISPR-based technologies, with the mission of improving performance and lowering costs.

-

In February 2023, Sherlock Biosciences announced that the U.S. Patent and Trademark Office issued a patent covering the diagnostic application of the Cas12 enzyme, solidifying the company’s leadership and operational freedom in the U.S. CRISPR diagnostics market. Sherlock holds exclusive U.S. rights to this patent through its agreement with Shanghai-based Tolo Biotech, along with additional Cas12 and Cas13 intellectual property from the Broad Institute, positioning the company at the forefront of CRISPR diagnostic IP globally.

CRISPR-based POC Diagnostics Market Report Scope

|

Report Attribute

|

Details

|

|

Market size in 2025

|

USD 567.63 million

|

|

Revenue forecast in 2033

|

USD 1,786.56 million

|

|

Growth rate

|

CAGR of 15.41% from 2025 to 2033

|

|

Base year for estimation

|

2024

|

|

Historical data

|

2021 – 2023

|

|

Forecast period

|

2025 – 2033

|

|

Quantitative units

|

Revenue in USD million/billion, and CAGR from 2025 to 2033

|

|

Report coverage

|

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

|

|

Segments covered

|

Product, technology, application, end-use, region

|

|

Regional scope

|

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

|

|

Country scope

|

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Norway; Sweden; Denmark; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

|

|

Key companies profiled

|

Mammoth Biosciences, Inc.; OraSure Technologies, Inc. (Sherlock Biosciences); Caspr Biotech; GenScript.; Integrated DNA Technologies, Inc.; Synthego; Revvity Discovery Limited; Twist Bioscience; Crisprbits; Danaher Corporation (Cepheid)

|

|

Customization scope

|

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

|

|

Pricing and purchase options

|

Avail customized purchase options to meet your exact research needs. Explore purchase options

|

Global CRISPR-based POC Diagnostics Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global CRISPR-based POC diagnostics market report based on product, technology, application, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2021 – 2033)

-

Technology Outlook (Revenue, USD Million, 2021 – 2033)

-

Cas9-Based

-

Cas12-Based (DETECTR Technology)

-

Cas13-Based (SHERLOCK Technology)

-

Other Emerging Cas Systems

-

-

Application Outlook (Revenue, USD Million, 2021 – 2033)

-

End-use Outlook (Revenue, USD Million, 2021 – 2033)

-

Regional Outlook (Revenue, USD Million, 2021 – 2033)

-

North America

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

link